Forex trading — or foreign exchange trading as it is sometimes referred to — is the marketplace for currencies. Even worse, the Forex market is open twenty-four hours a day five days a week, making it highly appealing for investors in search of market entry. This blog will help you understand the fundamentals of Forex trading including what Forex trading is and how to get started.

Forex Trading Fundamentals

As always, let us begin by understanding the basic concepts:

What is the Forex Market?

The Forex market can be defined as a market in which market participants can buy, sell, or exchange currencies at prevailing prices to one another. With more than $6 trillion being traded every day, it is quite obvious that the forex trading volume is by far the largest on the planet. It is the process of exchanging one currency for another. If for example, you believe that the euro will appreciate against the US dollar, you will buy the Euro vs US Dollar currency pair. Should the euro appreciate, you can then sell the pair at a profit.

Major Currency Pairs

As a trader in the forex market, you will notice that currencies come in pairs and these pairs are traded hence currency pairs. Below are some of the pairs that are most widely traded.

- EUR/USD: Euro and US Dollar

- GBP/USD: British Pound and US Dollar

- USD/JPY: US Dollar and Japanese Yen

- AUD/USD: Australian Dollar and US Dollar

The term ‘major pairs’ refers to these pairs as they have the highest volume in trades and liquidity. Liquidity is defined as the ability of a currency to be bought or sold with minimal impact on its current market price.

How Forex Trading Works

Forex trade is all about forecasting the direction of currency pairs, whether one currency will appreciate or depreciate relative to the other currency. For instance, if you believe that the European Union’s currency will appreciate when compared to the United States dollar, you would exchange Euros for dollars, which in essence means you buy Euros and sell Dollars. If your forecast comes to pass, you stand to benefit.

If you have decided you want to start Forex trading, the first step is to open an account with a Forex broker. Brokers act as intermediaries who provide you with a marketplace for trading currencies. They earn profits from their clients by charging a small payment termed a spread on every trading transaction that the clients perform.

Guide to Forex Trading and its Basic Concepts

What is a Forex Pair?

A Forex pair is simply two currencies that always go together. The first currency is known as the ‘base’ while the second is called the ‘quote’. Effectively, when one trades a Forex pair, that person is buying the first currency while selling the other. For instance, in the EUR/USD pair, the Euro is the base currency while the US Dollar is the quote currency.

What Are the Base and Quote Currencies?

Base and quote currencies are defined in each transaction on Forex through a Forex pair. The currency pair first mentions the currency which is base, and the other pair is mentioned later, that’s the quote currency. Given this, the price of a Forex pair states the price of the price quoted to buy that number of base units. For example, It is priced at around 1.20 – that means for every one Euro it costs you 1.20 US Dollars.

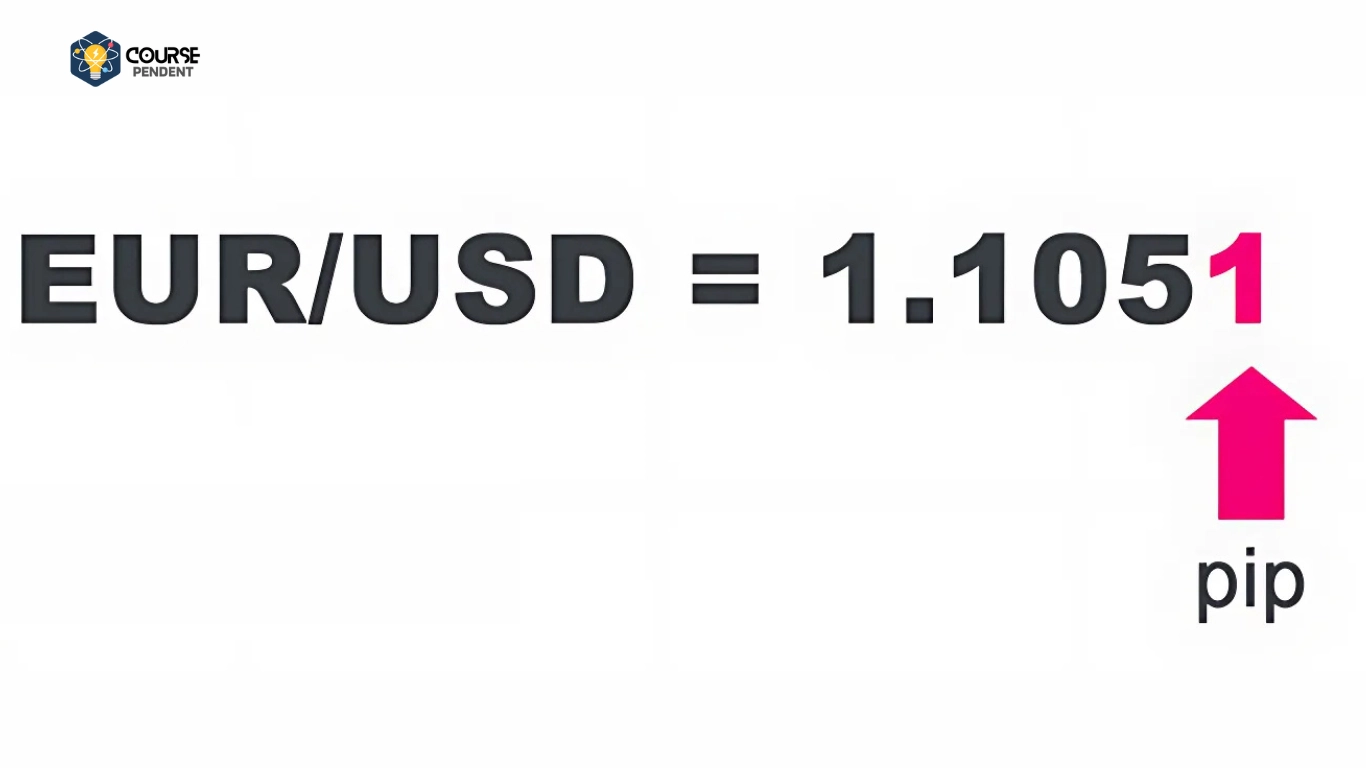

What is a Pip in Forex?

In forex terminology, a pip stands for a percentage in points, a metric that indicates the absolute minimum price change of a currency pair in a single instance. The final decimal place is taken into account and can be regarded as a measure of price fluctuations. It is important to focus on backward movements within a foreign exchange pair because this process can forecast the direction and duration of the pair’s subsequent performance. Numerous participants may engage in the foreign exchange market depending on the currency pair. There a simple example if the EUR/USD pair moves from 1.2000 to 1.2001, we say that it appreciates by one pip.

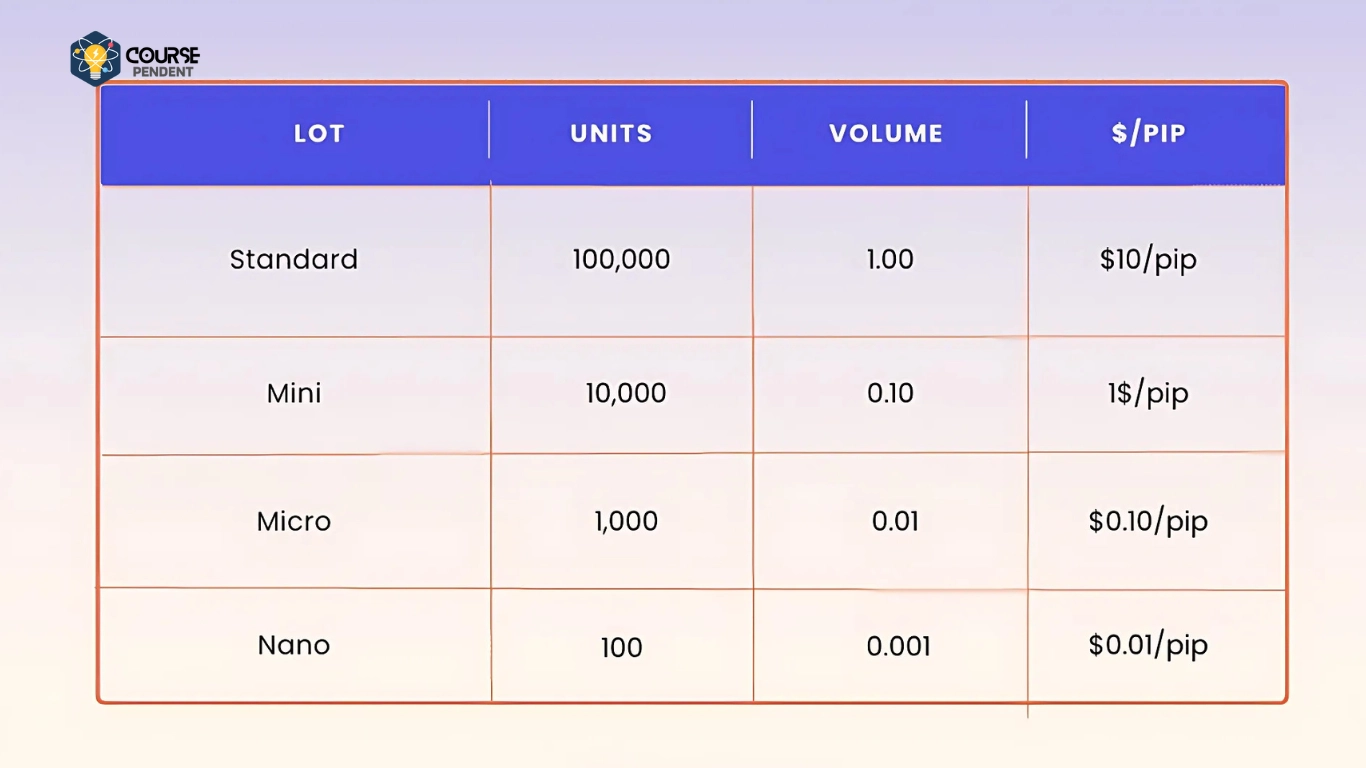

What does a Lot mean in Forex Trading?

When trading on the Forex platform, a lot can also be defined regarding unit size. The fundamental unit size is often said to be one standard lot which is equal to 100,000 units, however, one micro lot (1,000 units) or even mini lot (10,000 units) may also be viewed. In this context, it can also be noted that most brokers tend to provide more modern-sized mini and micro-lots which allow beginner traders in Forex to increase their leverage without risking much.

Types of Forex Orders

With the help of an order, a Forex trader may instruct the broker to either initiate a deal or close a deal. Orders effectively allow an individual to instruct the broker as to how they wish either to enter or exit a trade.

Market Orders

There is a common order which is known as the market order. This type of order does not involve too much complication with performance. A trader simply tells the broker what to do and any transaction will be completed at whatever the current market price is, regardless of the current delay. Most of the time, this kind of order gets executed immediately without further instructions.

Limit Orders

In the case of a limit order, a trader can choose the specific price to buy or sell the currency pair. For example, you are following the EUR/USD pair and the market trades for 1.2000, however, you wish to buy only if the price goes down to 1.1900. You will therefore place a limit order at 1.1900. Once the price gets to that level, the trade will go through.

Stop Orders

Stop orders are an effective way of ST protecting your profits or losses. If you are in a trade and that trade is moving against you, then a stop order will precisely close your trade at the price level you set the order at. For example, where for instance you have bought the EUR/USD pair for 1.2000 and you wish to protect your loss, you would have set a stop order at 1.1950. If the price touches 1.1950, the position will automatically be closed.

Forex Trading Strategies

Forex trading is also known as foreign exchange trading which is the practice of exchanging different currencies for profit. It involves buying one currency and selling another at a lower price and to achieve its success, a plan or strategy is needed. Here are some common ones in their line of work:

Scalping

Scalping is similar to a gambling strategy. Daring traders will not wait for hours or days to make a trade, rather, they will place hundreds of small trades throughout the day. They aim to make tiny profits before the price changes again. In this strategy, most traders don’t hold their trades for more than a few minutes—less than 60 seconds is common. It’s like trying to catch a fish in a fast-moving river: it works but requires lots of concentration, skill, and experience to do well.

Day Trading

Day trading, as the name suggests, involves trading within the confines of a single, normal workday. Traders purchase and sell various currencies all under a single day. They don’t leave their trades open for the night since they would expose themselves to large price fluctuations when the exchange is inactive This strategy is also popular among people who wish to make quick profits and have the availability to sit in front of their computer screens.

Swing Trading

The swing trading strategy is nearly akin to making a long trip and experiencing some good travel. This is because traders who indulge in this strategy hold onto the trades for several days or sometimes weeks to make more profit from bigger price differences. Their market charts are analyzed with respect to time and practice in the hope of perfecting their market timing. In all honesty, this swing strategy is much less stressful than scalping OR day trading since not much of the market activity is missed.

Risks and Rewards of Forex Trading

It is accurate to say forex trading carries high opportunity and great risk all at once. The nature of the market being dynamic implies that price levels can easily turn which can lead to a loss. I also want to make it clear that even though the business of Forex trading has its advantages it is also full of risks. Be always mindful of compliance with your risk appetite and ensure the use of appropriate risk management tools like aggressive SL and not risking more than one can willingly afford to lose.

FAQs

Is Forex Trading Halal?

Forex trading can be termed as halal as long as Shariah rules are observed in Forex trading like avoidance of riba and making sure that transparency is observed.

What is a Forex Trader?

A Forex trader can be defined as a person who conducts buying and selling of currency pairs in order to turn a profit due to shifts in the rates of exchange.

What is Forex?

Foreign exchange, a term more often shortened as Forex, is the worldwide marketplace for the trading of currencies.

Is There a Difference Between Forex Trading and Currency Trading?

Currency trading and forex trading are the same while buying and selling of currencies is concerned.

How Can I Make Money from Forex Trading?

To profit from Forex trading, you must make accurate currency forecasts and execute your trades appropriately. It is composed of a market analysis, a strategy, and risk measures.

Last Words

Forex trading is a dynamic and exciting market with great profit potential. However, it requires a solid understanding of how the market works, a well-thought-out strategy, and effective risk management. By following the basics outlined in this guide, you’ll be well on your way to understanding and participating in the Forex market. Remember, successful trading comes with patience, discipline, and continuous learning.